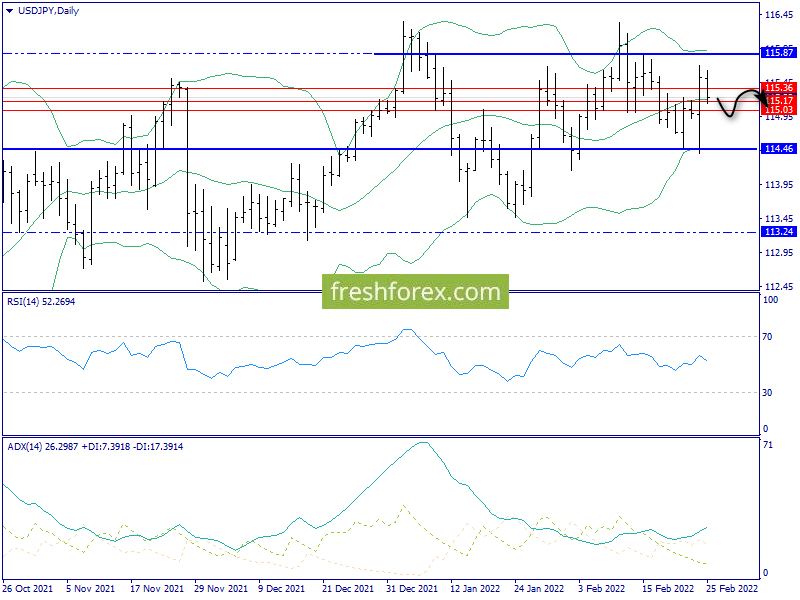

Daily chart: Very high volatility Yesterday did not change the general medium-term picture – the steam remains within the limits of horizontally oriented Bollinger envelopes (114.46-115.87).

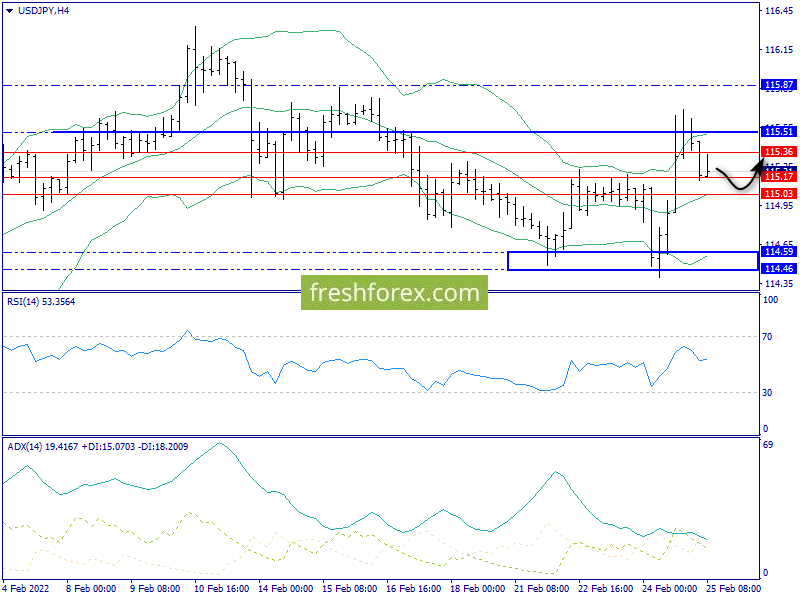

N4: The top envelope of the Bollinger was broken, therefore the activity of bulls from the middle band of the Bollinger (115.03) is possible.

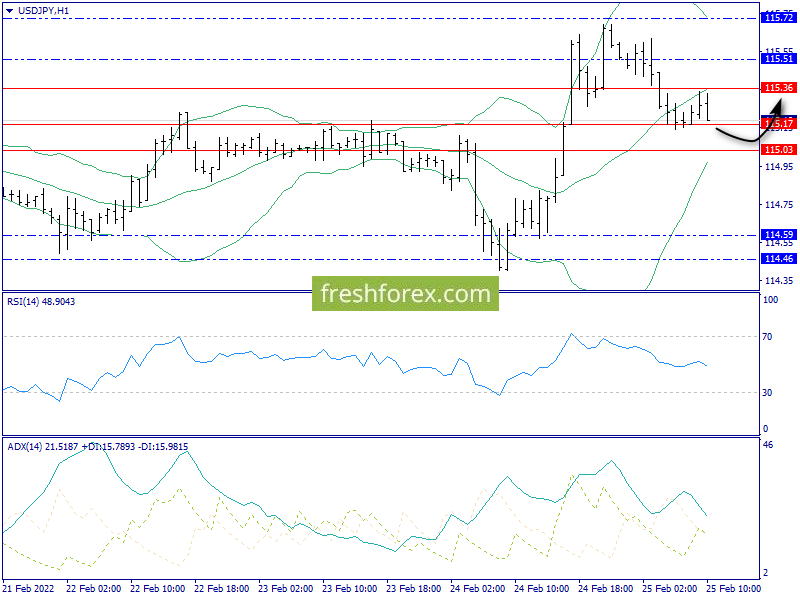

H1 : Strong intraday support area 115.00-115.02, where the fusion of the clockwise and H4-medium bands of the Bollinger is held.

Conclusions: Rebound up from the zone 115.00-115.02, then growth in the direction 115.36-115.50.

Trade Solutions: Shopping from Zone 115.00 to 115.36, 115.50.

In January, traders were faced with an indefinite, but very volatile situation in the markets – popular stock indexes were growing, then fell in price, the shares of the technological sector were cheaper, and oil is moderately, but significantly rushes in price. At such periods it is especially important to know which tools can bring profits.

Our analysts collected Investportfel, who smoothes anxiety and tell You are about family profidate tools. The expected portfolio yield can be 10%.

How to get:

1. Turn on the trading account in the amount of 90 USD to February 28, 2022

2. Send an account number that you replenished on the mail [Email Protected].